Today the Conservative Government delivered The Growth Plan, starting a new era focused on economic growth, whilst tackling the immediate energy crisis and removing barriers for businesses to build the infrastructure we need to grow the British economy.

The Conservative Government’s Growth Plan puts more money in people’s pockets by cutting National Insurance and Income Tax.

To deliver on this mission, the Chancellor has also announced 38 Investment Zones and over 100 infrastructure projects across the country to drive the investment and growth in the areas that need it the most.

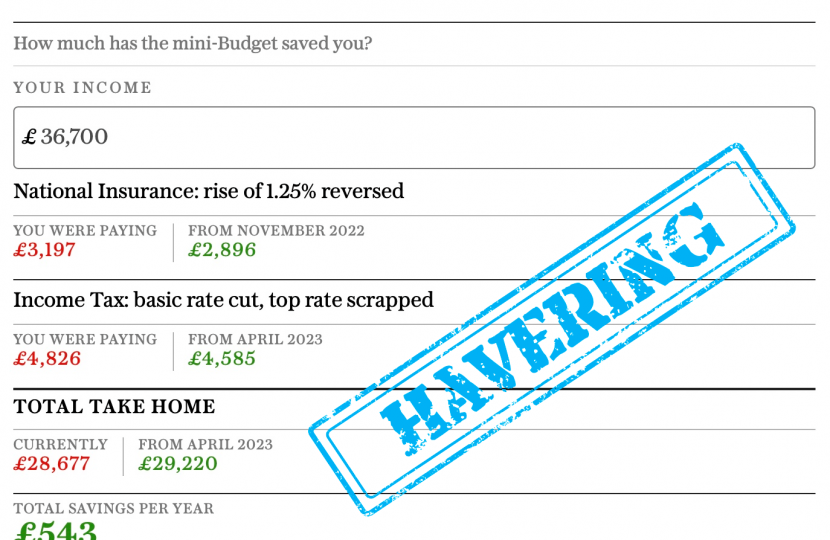

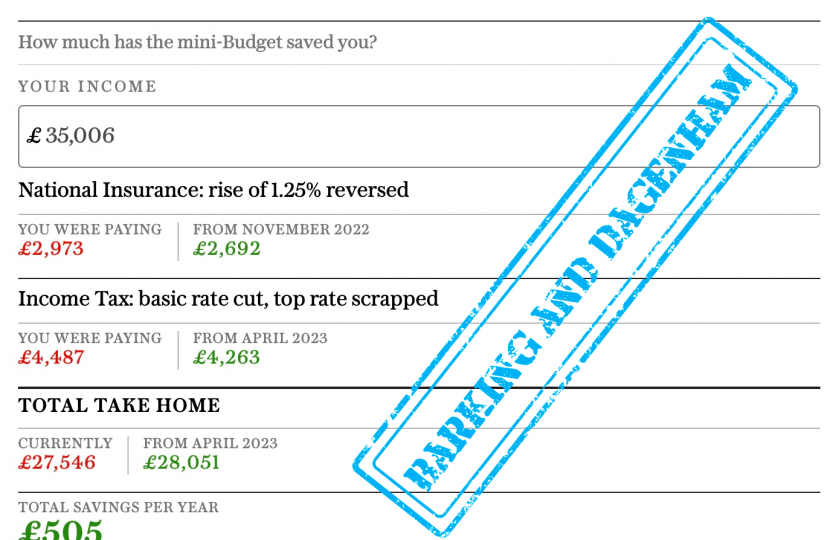

It means that a residents will take home extra £543 in Havering and £505 in Barking & Dagenham annually in average.

And on top of that their energy bills will be cut by up to £1,400 through the Energy Price Guarantee, whilst businesses eligible for The Energy Bill Relief Scheme will have their energy bills slashed by cutting the price of wholesale gas.

Alongside these measures our Conservative Government announced further personal cuts – including cutting stamp duty permanently by doubling the nil-rate band to £250,000 (from £125,000), increasing the nil-rate band for first time buyers to £425,000 (from £300,000) and increasing the value of the property which first-time buyers can claim relief to £625,000 from (£500,000).

These measures combined mean a typical family moving into a semi-detached property will save £2,500 on stamp duty and £1,150 on energy bills – and if they have a combined income of £50,000 around an additional £560 on tax. This is around £4,200 in total.

The Conservative Government’s Growth Plan also unleashes 38 Investment Zones across England, unlocking housing and driving growth through tax incentives and over 100 infrastructure projects that will be accelerated.

These measures will unleash growth through tax cuts and reform, tackle the immediate energy crisis, removing barriers for business, and building the infrastructure needed to grow the British economy.

The average take home extra is calculated by The Daily Telegraph at https://www.telegraph.co.uk/tax/news/calculator-stamp-duty-national-ins… using the average salary figures as provided by Plumplot available at: https://www.plumplot.co.uk/Romford-salary-and-unemployment.html calculation